A lack of effective competition in Australia’s domestic airline industry, which has characterised the industry for decades, has resulted in higher airfares and poorer service for consumers, the ACCC’s final Airline Competition in Australia report concludes.

The report, released today, explains that the expansion of Rex and the entry of Bonza have created an opportunity for the domestic airline industry to enter a more competitive period; however, the two airlines would need to grow significantly to compete meaningfully with Qantas Group and Virgin Australia.

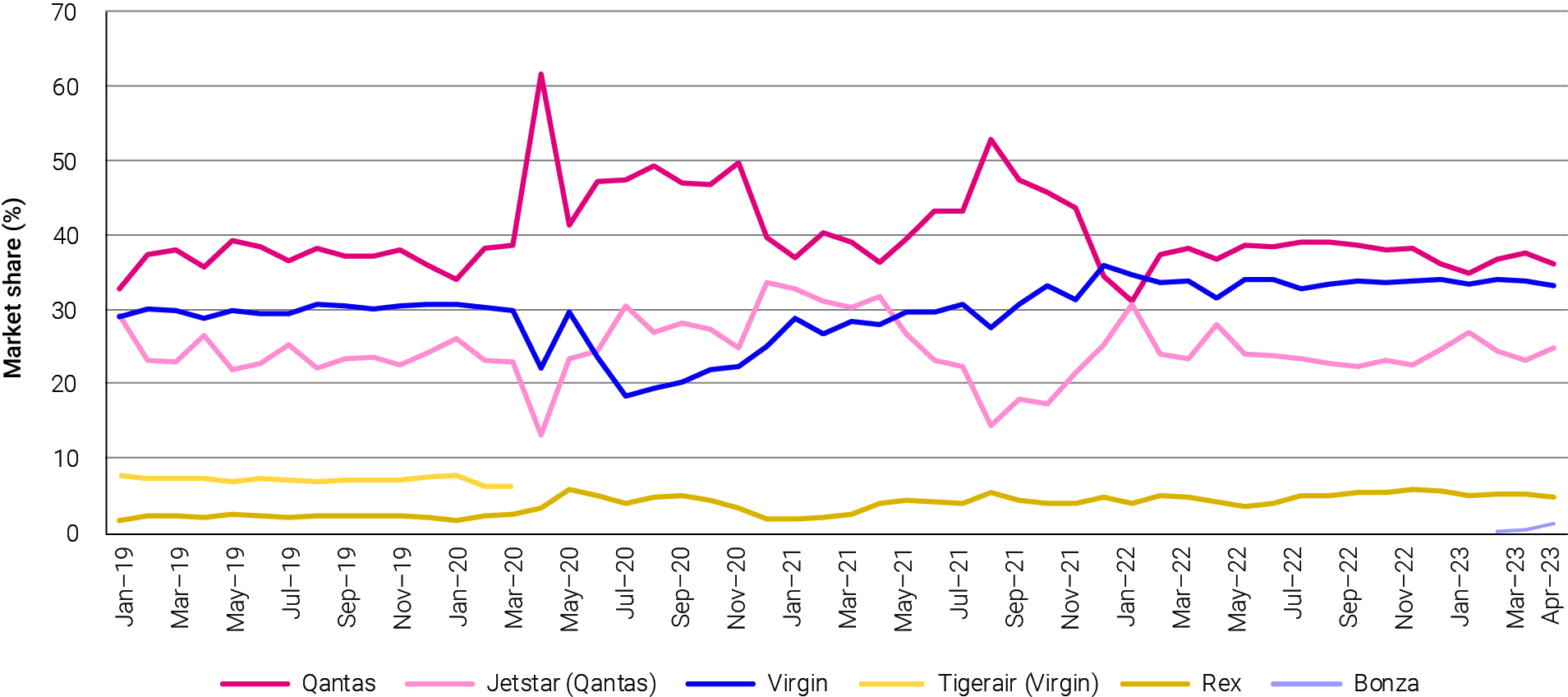

Over the last two decades, more than 90 per cent of domestic passengers flew with Qantas Group or Virgin Australia. In April this year, the two airline groups flew 94 per cent of all domestic passengers.

“Domestic aviation is one of the most concentrated industries in Australia, barring only natural monopolies such as electricity grids and rail networks,” ACCC Chair Gina Cass-Gottlieb said.

“Without a real threat of losing passengers to other airlines, the Qantas and Virgin Australia airline groups have had less incentive to offer attractive airfares, develop more direct routes, operate more reliable services, and invest in systems to provide high levels of customer service.”

“Rex’s expansion onto major intercity routes and Bonza’s launch have been positive developments for competition, but their share of the market is small and there are barriers to growth,” Ms Cass-Gottlieb said.

“While our airline monitoring direction is ending, we’ll continue to watch for anti-competitive behaviour and unfair business practices in the airline industry. If we see evidence of this occurring, we will use our full range of enforcement powers to achieve compliance with the law.”

Domestic flying still below pre-pandemic levels

More than a year after the end of state border closures, the latest available data (April 2023) shows that passenger and capacity numbers remain below pre-pandemic levels.

In April 2023, about 4.6 million passengers took domestic flights, which is 92 per cent of the passengers in April 2019. Total seat capacity across all airlines in April 2023 was six million, which was 93 per cent of pre-pandemic levels.

April is typically a peak period for leisure travel due to the Easter school holidays, but passenger numbers this year were not as high as expected, and declined from the previous month.

“The pent-up demand for air travel that characterised the industry for most of last year is starting to ease,” Ms Cass-Gottlieb said.

“Consumers appear to have become more price-sensitive as cost-of-living pressures have increased.”

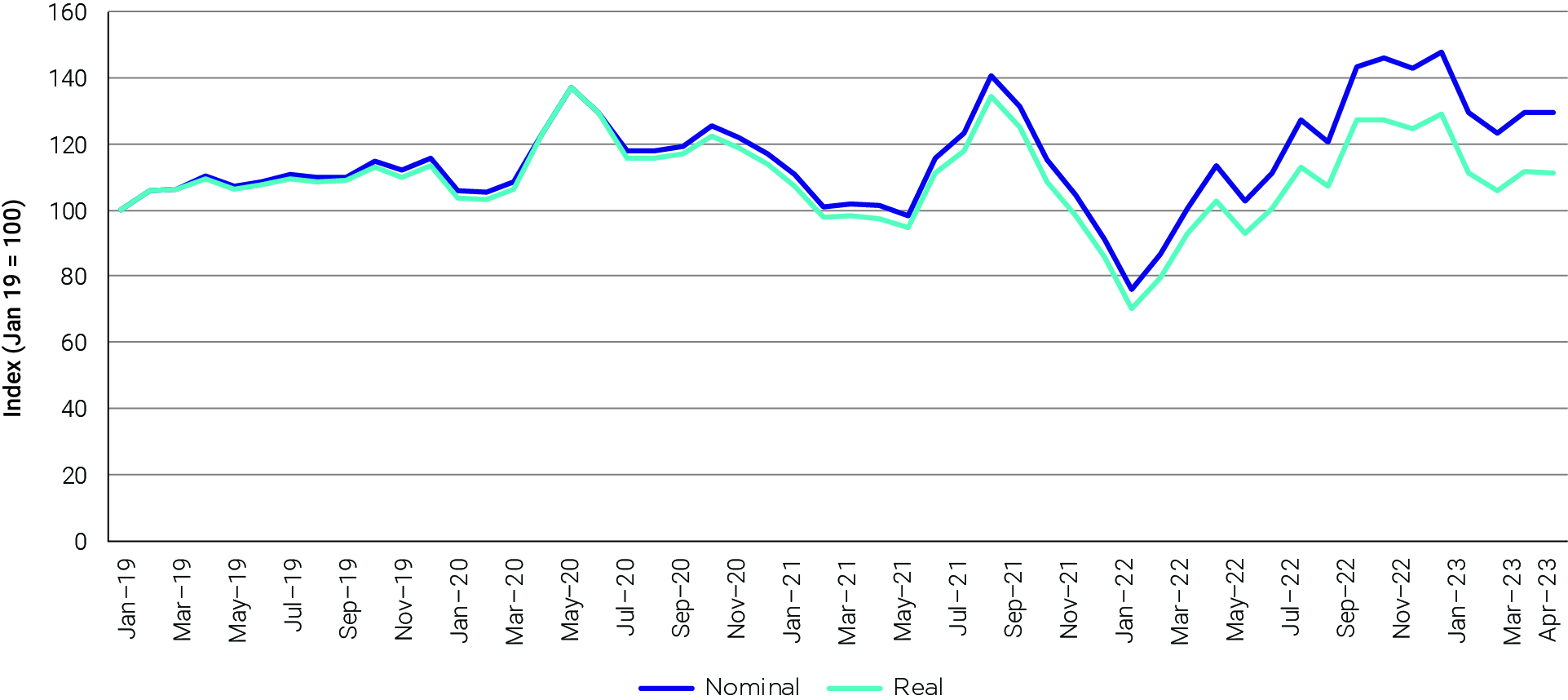

The easing of demand is reflected in cheaper airfares in 2023 so far, although they remain above pre-pandemic levels. The price of discount airfares fell by 14 per cent between February and May 2023 in real terms.

Average revenue per passenger, which represents average prices across all fare types, has also declined this year. The price of jet fuel has now almost halved in real terms since its peak in mid-2022, which has lowered the airlines’ costs.

“The downward trend in the price of jet fuel should enable the airlines to pass on more savings to consumers in the months ahead,” Ms Cass-Gottlieb said.

Some of the lag in the industry’s recovery may also be due to a structural change in which online technology continues to replace some business travel.

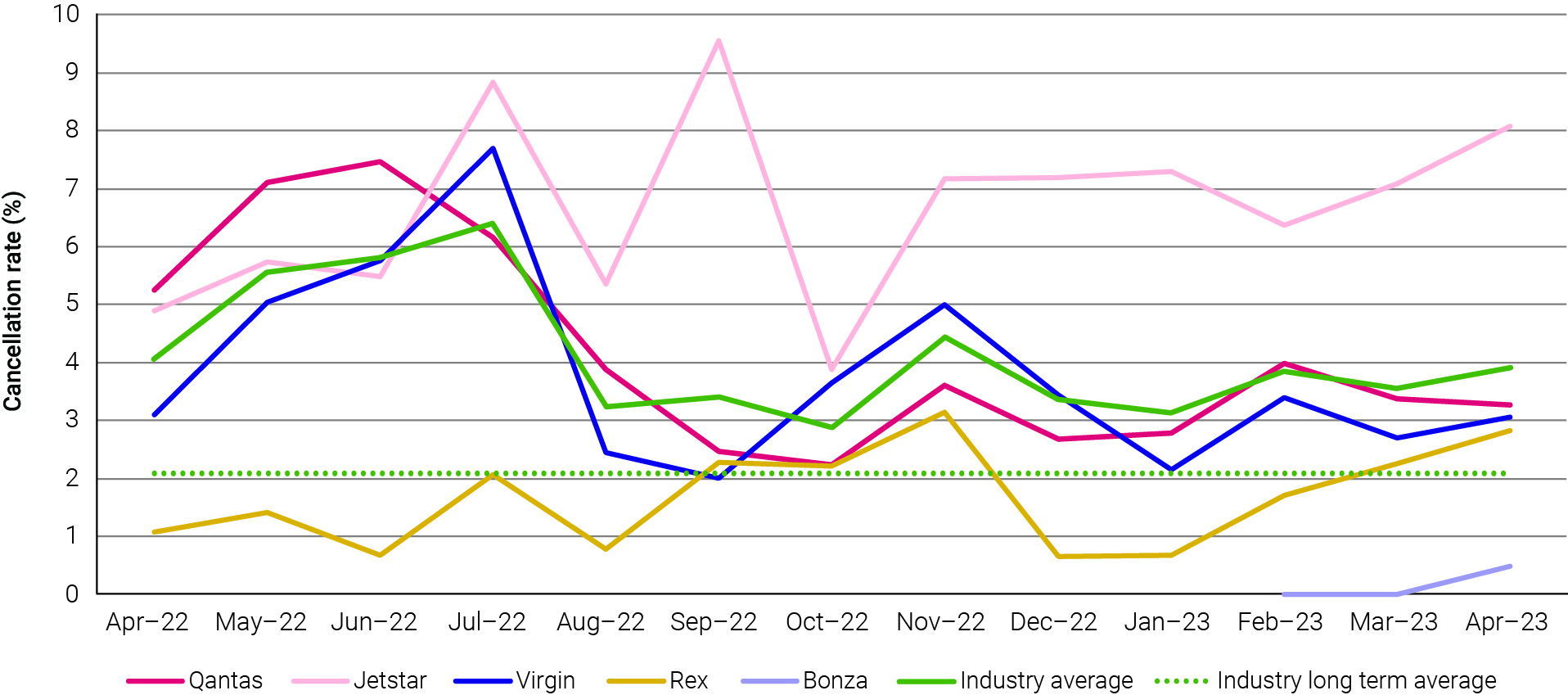

The industry cancelled 3.9 per cent of all domestic flights in April 2023, which was higher than in January, and above the long-term average of 2.1 per cent. Nearly one-third of all domestic flights arrived more than 15 minutes late, compared to the long-term average of 18.5 per cent.

“After showing signs of improvement earlier in the year, it is disappointing for consumers that the airlines’ service reliability has declined again and remains worse than long-term trends,” Ms Cass-Gottlieb said.

Jetstar continued to perform significantly worse than the rest of the industry, cancelling 8.1 per cent of flights in April. Jetstar’s cancellation rate in April was more than double the other airlines.

Competition and consumer protection reforms are needed

The report explains that reforming the legislative scheme that allocates take-off and landing slots at Sydney Airport would be the best way to promote competition in the domestic airline industry. Several possible reforms to better manage demand at Sydney Airport, which is Australia’s busiest, have already been identified through a Government-led review and stakeholder working groups.

“Access to peak time slots at Sydney Airport is critical for new and expanding airlines seeking to build an intercity network. Without legislative reform to the airport’s demand management scheme there will not be any material improvement in domestic airline competition in Australia in the foreseeable future,” Ms Cass-Gottlieb said.

The report also states that sustained declining levels of customer service in the airline sector warrant the Government considering new regulatory incentives for airlines to invest in their customer service.

“There is a clear need for a truly independent and external dispute resolution ombuds scheme, which has the power to make binding decisions,” Ms Cass-Gottlieb said.

The ACCC has also strongly advocated for reform to the consumer guarantees under the Australian Consumer Law, to make it illegal for businesses to fail to provide a remedy for consumer guarantees failures.

“Reform to the consumer guarantees to make them enforceable would dramatically improve incentives for all businesses, including airlines, to comply with their obligations and more effectively protect consumer rights,” Ms Cass-Gottlieb said.

ACCC’s monitoring and reporting role ends

The ACCC has been monitoring and reporting on the domestic airline industry for the last three years. This is the 12th and final report under the direction issued by the former Treasurer in 2020.

The ACCC’s monitoring and reporting during the pandemic years provided transparency at a critical time for the industry, including for the expansion of Rex and entry of Bonza. The ACCC will continue to watch the airlines’ conduct and, where necessary, take action to achieve compliance with competition law and the Australian Consumer Law.

Airline passenger market shares across all domestic routes – January 2019 to April 2023

Source: Data collected by the ACCC from Qantas, Jetstar, Virgin Australia, Rex and Bonza.

Index of average fare revenue per passenger across all routes – January 2019 to April 2023

Source: ACCC calculations using data from the ABS and data collected by the ACCC from Qantas, Jetstar, Virgin Australia, Rex and Bonza.

Note: The average revenue per passenger includes both economy and business fare revenue. It excludes ancillaries and Tigerair data. Data has been adjusted for inflation using the latest ABS CPI quarterly data up to March 2023.

Airline cancellation rates – April 2022 to April 2023

Note: A flight is regarded as a cancellation if it is cancelled or rescheduled less than 7 days prior to its scheduled departure time. The industry total and long-term average is weighted across all airlines and all airports; and presented at the April 2023 level for all months.

Source: BITRE, On time performance time series – April 2023; data collected by the ACCC from Bonza. Qantas figures include QantasLink and Virgin Australia figures include VARA.

Background

On 19 June 2020, the ACCC was directed by the former Treasurer to monitor the prices, costs and profits of Australia’s domestic airline industry and provide quarterly reports to inform Government policy. The direction expires in June 2023. This is the last report under this direction.