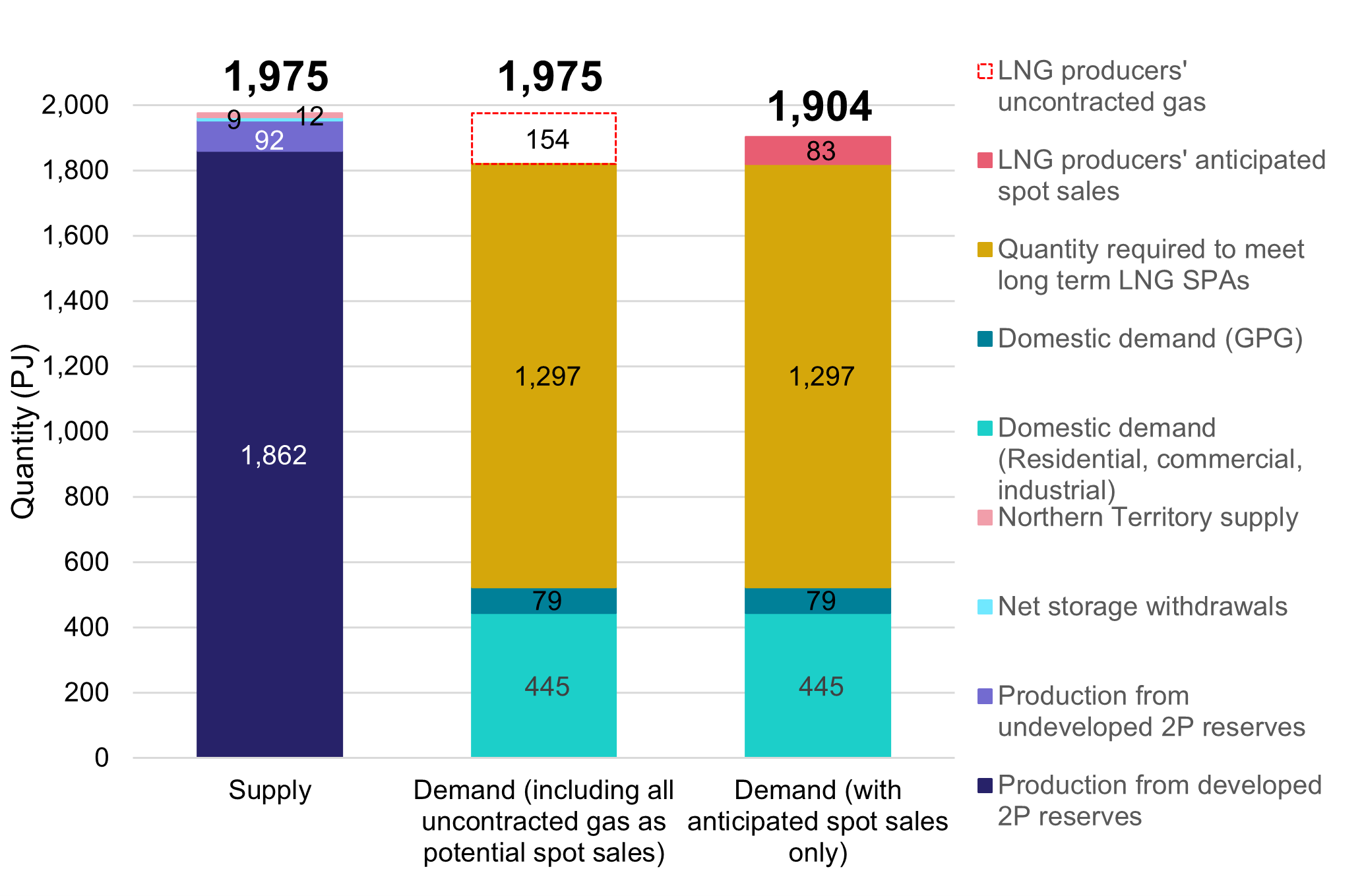

The ACCC’s latest gas inquiry report forecasts balanced supply and demand in 2024 if Queensland’s LNG producers export all their currently uncontracted gas, or a 71 petajoule (PJ) surplus if they only export their currently anticipated spot sales. This is down from the 90 PJ surplus forecast in the ACCC’s June 2023 report.

The report focuses on the supply of and demand for wholesale gas in the east coast gas market, drawing on data between February and August 2023.

While, overall, the supply of gas in 2024 is forecast to be sufficient across the east coast, the LNG producers will need to commit small amounts of additional gas to the domestic market to avoid a shortfall in winter 2024.

Gas will also need to be transported from Queensland to the southern states of New South Wales, the Australian Capital Territory, Victoria, South Australia and Tasmania to avert local shortfalls next winter.

“The LNG producers still have a substantial amount of uncontracted gas, which they have the option to either export, after meeting their Heads of Agreement obligations, or supply domestically,” ACCC Commissioner Anna Brakey said.

“Contracting activity between gas producers and users has generally picked up this year after a stagnant period late last year and in early 2023, but as of August this year large volumes of gas remained to be contracted for 2024.”

Importantly, the report does not reflect the full impact of the new Gas Market Code on domestic gas supply, which took effect in September 2023. The report does, however, capture the impact of the Government’s emergency price cap, which was in place throughout the reporting period, and which applied to gas supplied in 2023 that was contracted after 22 December 2022. The ACCC continues to monitor wholesale gas market conduct but has found good compliance with the cap to date.

The prices offered by producers for 2024 supply fell by about 45 per cent between February and August 2023, to $14.60 per gigajoule (GJ). The prices offered by retailers for 2024 supply also fell over this period by about 21 per cent, to $19.50 per GJ.

In August 2022, during the worst of the global energy crisis, producers’ price offers were about $49 per GJ for 2024 supply.

The report also shows that producers appear to have been selling gas under short-term contracts for 2023 supply at or below the $12 per GJ cap since it was introduced in December 2022.

“The combination of the Government’s emergency price cap and lower international LNG prices has resulted in Australia’s domestic gas prices falling significantly since the highs of last year,” Ms Brakey said.

Figure 1: Forecast east coast supply-demand balance in 2024 (PJ)

Source: ACCC analysis of data obtained from gas producers in October 2023 and of the domestic demand forecast (Orchestrated Step Change scenario) from AEMO's March 2023 GSOO.

Note: Totals may not add up due to rounding.

Long-term supply outlook

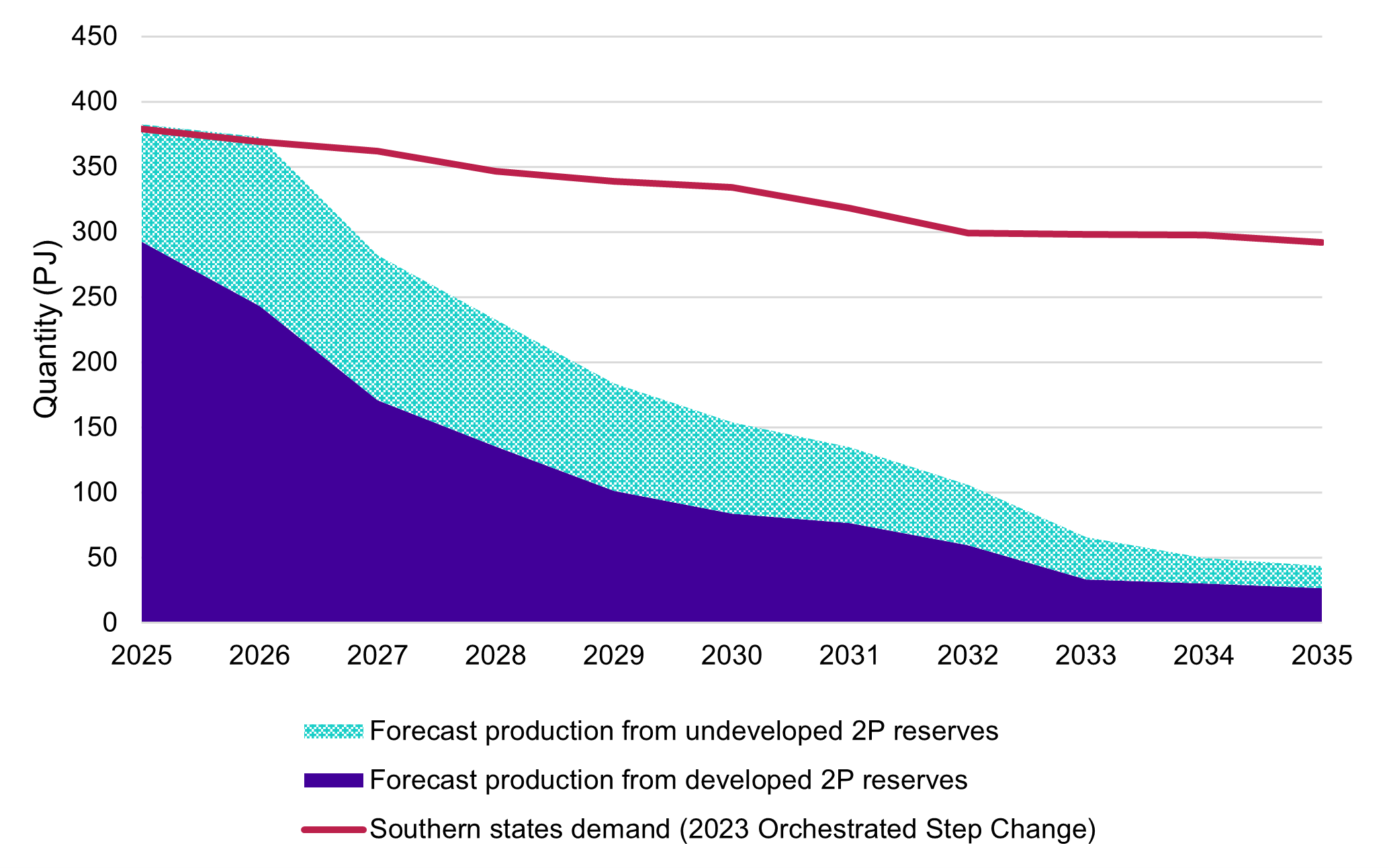

The overall east coast gas market is expected to have enough supply to meet demand until 2028, but forecasts indicate the southern states will face significant shortages of locally produced gas from 2027. Transporting gas from Queensland to the southern states will be increasingly important to cover these potential supply gaps.

However, this report does not incorporate gas committed by producers under the Gas Market Code exemptions framework. The ACCC anticipates committed volumes will have a positive impact on the domestic east coast supply outlook.

The report cautions that additional sources of gas supply will be needed over the coming decades to meet current demand projections and support Australia’s transition to a renewables-based energy system.

Without the development of new gas fields, pipelines and potentially LNG import terminals, or without a significant reduction in demand, the east coast will experience sustained gas shortfalls.

Figure 2: Forecast supply and demand in the southern states 2025-35

Source: ACCC analysis of data obtained from gas producers as at September 2023 and domestic demand from AEMO's 2023 GSOO.

Note: This chart includes forecast production from developed and undeveloped 2P reserves in the Gippsland, Bass, Otway, Sydney, Gunnedah and Cooper basins.

Review of retailer behaviour

The ACCC has been reviewing retailer behaviour, focusing on retail supply to commercial and industrial customers in the east coast gas market.

The first stage of the review found the tight and volatile market conditions in 2022 and early 2023 posed significant challenges for retailers and commercial and industrial gas users, and contributed to a deterioration in retail competition and some retailers’ selling practices.

It also found that conditions in the latter half of 2023 had started to improve, with retail competition increasing and some retailers reverting to their standard selling practices.

“While the improvements observed in the latter half of 2023 are encouraging, some retailers’ selling practices fall short of what we would expect in a workably competitive market and mirror what retailers themselves have previously reported when buying gas from producers,” Ms Brakey said.

“We’ll be closely monitoring retailer selling practices next year to see if the minimum standards for producer selling practices provided by the Gas Market Code flow through to the practices of retailers.”

“The second stage of our retailer review, which we will commence shortly, will focus on retailer pricing practices. If we identify any systemic issues in retailer behaviour, we will consider making recommendations to Government.”

Background

In 2017, the Australian Government directed the ACCC to conduct a wide-ranging inquiry into the supply of and demand for natural gas in Australia, and to publish regular information on the supply and pricing of gas. The ACCC will conduct the inquiry until 2030 after the Government extended it 2019 and again in 2022.

In September 2022, the Australian Government and the three east coast LNG producers signed a Heads of Agreement with the objective of preventing a gas supply shortfall through access to secure and competitively priced gas for the east coast domestic market. Under the terms of the Heads of Agreement, excess gas produced by the LNG producers must be offered to the domestic market for reasonable supply periods, with reasonable notice, on competitive market terms and at prices no more than international customers will pay, before being offered to the international market.

In December 2022, the Competition and Consumer Act was amended to introduce a new part that relates to the gas market. These amendments allowed the Australian Government to temporarily introduce an emergency price cap on the supply of regulated gas late last year, and the Gas Market Code this year. The code commenced on 11 July 2023, with a two-month transition period.

Anyone who suspects or has information about a potential breach of the price cap, the code or avoidance of the price cap or the code is strongly encouraged to report it to the ACCC. Gas market participants can also report conduct using an anonymous online portal.

The ACCC’s next supply-demand outlook for the gas inquiry will be published in the March 2024 report, and the next full interim report will be the June 2024 report.